China – India, versus Indonesia

Analysis: Indonesia could be a better bet than China or India

There are different kinds of investors looking for different kinds of opportunities. One size doesn’t fit all. Whether you are an Indonesian looking to invest overseas or an overseas investor considering what suits you best in Asia, pause, and have another look at the pros and cons of the two heavyweights: China and India, versus middleweight Indonesia. You could be in for a pleasant surprise.

The sheer size of the billion-plus populations of China and India are huge attractions, literally speaking. If 240 million isn’t big enough for you, then you know where you must go. But if the size of Indonesia is attractive, consider the many advantages it offers over its two bigger

Asian neighbors. Both the giants have large populations, but they also have major chinks in their armor. Large populations need even more jobs, more essential services, more infrastructure every year. Most economists would agree that both China and India need at least 6 percent annual growth in GDP to keep the economy moving forward. Without that 6 percent, critical indicators for poverty, healthcare, education and employment would slide.

With the breakup of the eurozone looming large, China’s export-driven factory-to-the-world could be in more pain than it already is in. From that perspective, India’s inward-looking and self-reliant consumer economy is in safer waters, even when global tradewinds go awry. But a further slowdown in foreign investments consequent to a euro meltdown would push India’s growth rate down even harder. If we add the unpredictable nature of Mother Nature into the mix, a bad monsoon on top of a euro gone bad could bring India to below the minimally required 6 percent GDP growth trajectory. Such a possibility is well within the realms of imagination.

For Indonesia, in sharp contrast, one or even a cocktail of both elements would have little impact. If you’re shaking your head in disagreement, let’s make it easier to agree. Such a turn of events would have much less impact on Indonesia, than it would have on China or India. That’s because Indonesia’s domestic economy is working well, producing and consuming with a voracious appetite much like India. But history proves that the Global Financial Crisis of 2008 caused hardly a ripple, except on the floor of the IDX. The vagaries of an annual monsoon aren’t an issue. Even a tsunami the size of 2004 did little damage, the quick recovery adequate testimony to Indonesia’s resilience.

Indonesia with 240 million people has fewer challenges in comparison to China and India. It is under far less pressure on critical areas such as poverty and employment. At 5 to 6 percent annual growth in GDP, Indonesia registers comfortable progress on vital fronts. At that pace, the country’s middle-class has grown from 28 percent of households to 45 percent in just the last five years. This isn’t the government’s propaganda machine at work, but Roy Morgan Research interviewing robust samples around the country week after week, year after year. Even if similar data were available in China and India to facilitate an identical definition of “middle class”, it is most unlikely that either would have numbers similar to Indonesia. My educated guess, based on piecing different sets of information together, would be less than 20 percent for India and 40 percent at best for China. The biggest external threat for the Indonesian economy is the price of oil. Even that threat, as witnessed in 2007, led to a slowdown in consumption for just six months with a full and equal recovery in the next six. On the other hand, much of Indonesia’s exports are natural resources, essentials not luxuries.

Another fuel price hike would hurt Indonesia temporarily, but the degree of pain for the average citizen would be far greater for China and India. The primary difference is that this country is more blessed by nature than the two giants. Their natural resources are scarce, in comparison to Indonesia’s wealth. Their demographic challenges are far greater as well. As I’ve said before, this is a rich country with poor people. Nobody would say that about the two bigger Asian neighbors. They have to work much harder to solve their major problems.

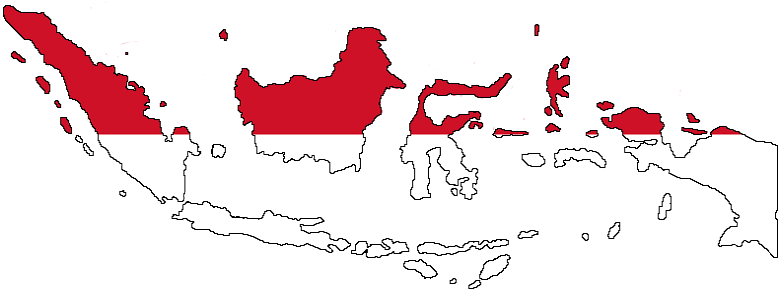

Unlike those two countries, the demand for consumer goods and services remains strong across the archipelago. Despite all the news of gloom and doom from far and near, the KADIN-Roy Morgan Consumer Confidence index remains at world-beating levels. Across the spectrum, demand for consumer goods and services remain healthy. The appetite for just about everything, from shampoo to edible oil, mobile phones to motorcycles, bank accounts to air travel, all indicators are still sailing strong. Graphics like the chart accompanying today’s column have started telling new stories, visualizing the transitions that have already started. 3/4 of Indonesians 14 years of age and older already have a mobile phone but that isn’t worrying the manufacturers of handsets. Quite simply, the replacement market has overtaken the market for new entrants. Similarly, convenience stores are mushrooming everywhere, not just in the big cities. If some of the old mom-and-pop stores are converting to franchises of the big chains, business will be good for all.

Could Indonesia do even better than it is? Endemic corruption, with all its accompaniments, is the primary impediment to greater progress. But businesses and consumers are simply getting on with their lives, they’ve learned to ignore the ineptitude of the powers-that-be. That’s good news too. If the government can run on autopilot, so can the economy. As long as the governor of Bank Indonesia has his hand on the wheel, Indonesia will cruise along.

These opinions are influenced by Roy Morgan Single Source, the country’s largest syndicated survey. More than 26,000 respondents are interviewed every year, week after week. The data is projected to reflect 87 percent of the population 14 years of age and over.

By: Debnath Guharoy, Roy Morgan

6 / 13 / 2012 11:32 pm

Saya jg sangat tdk setuju dg gambar petanya. Kalau mmg petanya tdk cukup utk dimuat, ya tdk usah dimuat, atau bisa diperkecil. Peta yg ada berikan menyesatkan; tolong diperbaiki.